Eli Lilly in Advanced Talks to Acquire Gene Editing Partner Verve Therapeutics for $1.3 Billion

Eli Lilly, the pharmaceutical giant, is reportedly in negotiations to acquire its gene editing partner, Verve Therapeutics, in a deal valued at up to $1.3 billion. This potential acquisition marks a significant development in the gene editing landscape and underscores Lilly's commitment to expanding its presence in cutting-edge therapeutic approaches.

Deal Structure and Financial Details

According to sources familiar with the matter, as reported by the Financial Times, Eli Lilly is considering an upfront payment of nearly $1 billion for Verve Therapeutics. The deal structure also includes potential milestone payments of up to $300 million, bringing the total possible value to $1.3 billion.

This move comes two years after Lilly's initial $60 million upfront investment in Verve for a preclinical cardiovascular gene editing therapy. In 2023, Lilly further solidified its relationship with Verve by paying $250 million to Beam Therapeutics for opt-in rights to Verve's gene therapy programs targeting PCSK9, ANGPTL3, and an undisclosed target.

VERVE-102: A Promising Gene Editing Candidate

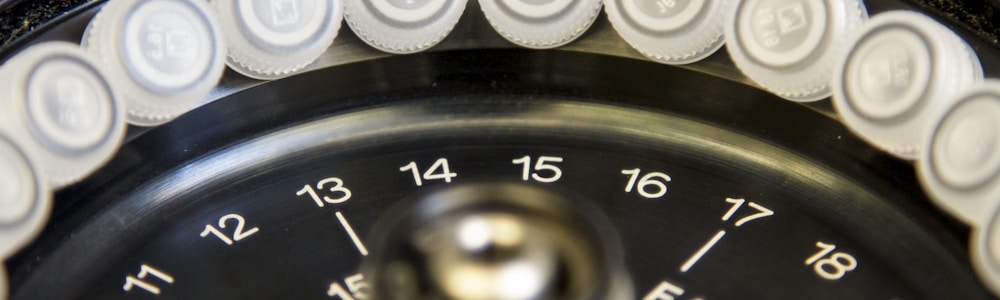

The potential acquisition follows recent positive developments in Verve's pipeline, particularly with VERVE-102, a drug candidate designed to reduce LDL cholesterol and PCSK9 levels. Early-stage data from April 2025 demonstrated VERVE-102's efficacy without the liver enzyme elevations that had previously halted trials of its predecessor.

VERVE-102 utilizes a different lipid nanoparticle (LNP) delivery system compared to its earlier counterpart, addressing the safety concerns that led to the suspension of the original PCSK9 program. This successful pivot has seemingly renewed Lilly's confidence in Verve's approach to gene editing therapeutics.

Lilly's Strategic Expansion in Gene Editing and Beyond

The talks with Verve Therapeutics are part of a broader strategy by Eli Lilly to bolster its pipeline and capabilities in emerging therapeutic areas. Earlier this year, Lilly acquired Scorpion Therapeutics' PI3Kα pipeline for up to $2.5 billion and purchased SiteOne Therapeutics, gaining access to a non-opioid pain asset poised for phase 2 trials.

If the Verve acquisition doesn't materialize, industry observers expect Lilly to make a decision in the second half of 2025 regarding additional opt-in rights for Verve's gene editing programs. Such a move would involve Lilly covering one-third of global development costs in exchange for an equal share of U.S. profits and joint commercialization rights for VERVE-102 in the United States.

References

- Eli Lilly in talks over $1.3B deal for gene editing partner Verve Therapeutics: FT

Eli Lilly is in talks to buy gene editing partner Verve Therapeutics for up to $1.3 billion, according to a report in the Financial Times.

Explore Further

What are the specific milestone achievements required for Verve Therapeutics to receive the additional $300 million in payments?

What competitive advantages does VERVE-102 have over existing LDL cholesterol-lowering therapies?

What are the strategic implications of Lilly's acquisition of Scorpion Therapeutics' PI3Kα pipeline for its gene editing portfolio?

Who are the primary competitors in the gene editing landscape potentially affected by Lilly's acquisition of Verve Therapeutics?

What are the basic profiles of Eli Lilly and Verve Therapeutics in terms of their position and capabilities in the gene editing field?