Astellas Strengthens CLDN18.2 Portfolio with $1.34B Licensing Deal for Promising ADC

Astellas Pharma, the Japanese pharmaceutical giant, has made a significant move to bolster its position in the CLDN18.2-targeting oncology space. The company has entered into a licensing agreement with Chinese biotech Evopoint Biosciences for a phase 2 antibody-drug conjugate (ADC), potentially worth up to $1.34 billion. This deal comes less than a year after Astellas secured the first anti-CLDN18.2 approval in the United States.

Deal Structure and Financial Details

Under the terms of the agreement, Astellas will pay Evopoint an upfront fee of $130 million, with an additional $70 million in potential near-term milestones. The total value of $1.34 billion includes further payments tied to development, regulatory, and commercialization milestones. Evopoint also stands to receive royalties on future net sales if the asset gains approval.

In exchange, Astellas will obtain exclusive worldwide rights to develop and commercialize XNW27011, excluding China, Hong Kong, Macao, and Taiwan. This strategic acquisition aligns with Astellas' efforts to expand its oncology pipeline and maintain its leading position in precision medicine.

XNW27011: A Promising CLDN18.2-Targeting ADC

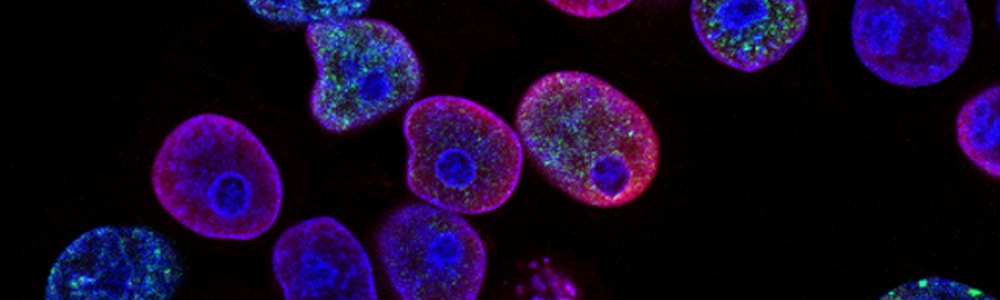

XNW27011 is currently undergoing evaluation in a phase 1/2 trial for patients with advanced or metastatic solid tumors, including gastric, pancreatic, colorectal, ovarian, and other cancers. The drug candidate targets CLDN18.2 (Claudin 18.2), a tight junction protein that forms part of the complex binding epithelial cells in the gastrointestinal system. CLDN18.2's expression on the surface of tumor cells makes it an attractive therapeutic target in oncology.

Adam Pearson, Astellas' Chief Strategy Officer, emphasized the strategic importance of this acquisition, stating, "XNW27011 is a promising new asset that complements Astellas' pipeline and enhances our leading position in precision oncology. We look forward to harnessing our expertise in targeting CLDN18.2 and specialized knowledge in GI cancers to advance XNW27011 and deliver meaningful outcomes to patients."

CLDN18.2 Landscape and Industry Competition

Astellas has already established itself as a leader in the CLDN18.2 space with the approval of Vyloy (zolbetuximab) in October 2024, marking the first FDA-approved treatment targeting this protein. However, the field remains highly competitive, with several major pharmaceutical companies pursuing CLDN18.2-directed therapies.

AstraZeneca, Leap Therapeutics, Legend Biotech, and Moderna are all actively developing drugs targeting CLDN18.2. Conversely, some companies have faced setbacks, with Elevation Oncology recently discontinuing its CLDN18.2-targeting ADC program for gastric cancer due to disappointing phase 1 results. Merck & Co. also exited the field by returning global rights to Kelun-Biotech's CLDN18.2-directed ADC SKB315.

As the annual American Society of Clinical Oncology (ASCO) conference approaches, Astellas is poised to showcase its progress in the CLDN18.2 field, with 16 presentations scheduled. The company's strategic focus on ADCs, hybrid approaches, bispecifics, and target-based drug discovery aligns with broader industry trends favoring these modalities over more complex and costly cell therapies and radiopharmaceuticals.

References

- Astellas aspires to strike CLDN18.2 gold again with ADC licensing deal worth up to $1.34B

Less than a year after garnering the first anti-CLDN18.2 approval in the U.S., Astellas Pharma is not resting on its laurels. The Japanese pharma giant is doubling down on the star solid tumor target with a new licensing deal for a phase 2 antibody drug conjugate worth up to $1.34 billion.

Explore Further

What are the specific terms and conditions of the collaboration model between Astellas and Evopoint in this licensing deal?

What efficacy and safety data are available from the phase 1/2 trial of XNW27011 for the involved pipeline?

How does the CLDN18.2-targeting pipeline developed by Astellas compare to those from competitors like AstraZeneca and Moderna?

What strategic advantages does Astellas expect to gain from acquiring exclusive rights to XNW27011 outside of Greater China?

Are other competitors in the biotech industry pursuing similar large-scale licensing deals in the CLDN18.2 space?