Boundless Bio Faces Setbacks, Pivots Strategy Amid Clinical Trial Struggles

Boundless Bio, a San Diego-based biotech company, is undergoing significant changes following disappointing results from its phase 1/2 clinical trials. The company has announced a strategic pivot, staff reductions, and a shift in its drug development focus.

Clinical Trial Shortcomings Lead to Strategic Shift

Boundless Bio's lead candidate, BBI-355, a CHK1 inhibitor, has encountered obstacles in its development as a monotherapy. The phase 1/2 study in patients with oncogene-amplified solid tumors revealed hematological toxicity at or near doses associated with clinical activity, resulting in a narrow therapeutic window that has derailed plans for its use as a single agent with continuous dosing.

Additionally, attempts to combine BBI-355 with other inhibitors, including the EGFR inhibitor erlotinib and FGFR inhibitor futibatinib (sold as Lytgobi by Taiho Oncology), proved challenging. These combinations were not well tolerated at doses believed necessary for robust, sustained anti-tumor activity, leading Boundless to halt further development in the current arms of the phase 1/2 trial.

Pivot to Combination Therapy and New Development Candidate

In response to these setbacks, Boundless Bio is now focusing on a combination approach. The company plans to test BBI-355 in conjunction with BBI-825, an RNR inhibitor that was previously shelved due to lack of dose-proportional exposure. According to the biotech, there is a strong mechanistic rationale for this cocktail, which they believe may eliminate the need for continuous dosing and avoid overlapping toxicity.

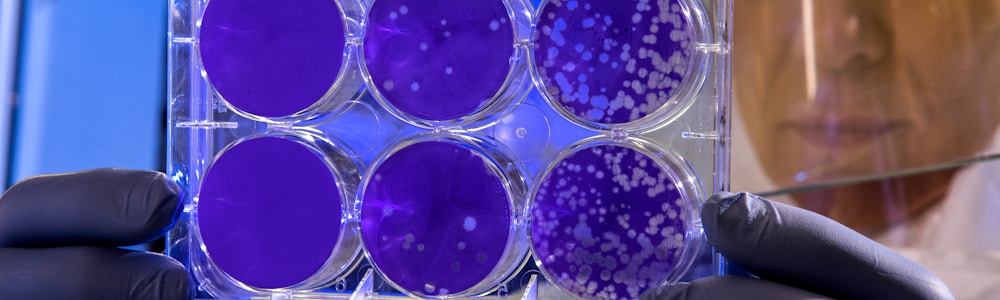

Preclinical data supporting this new direction includes synergistic cytotoxicity in cancer cell lines and tumor regression in mouse xenograft models using weekly dosing at exposures not associated with hematological toxicity. Boundless intends to initiate clinical development of this combination therapy later this year.

In a parallel development, the company has selected BBI-940 as the development candidate from its kinesin degrader program. Boundless remains on track to file an Investigational New Drug (IND) application for BBI-940 in the first half of 2026.

Financial Restructuring and Workforce Reduction

To extend its cash runway and adapt to the new strategic direction, Boundless Bio has implemented significant cost-cutting measures. The company has laid off approximately one-third of its staff, reducing its workforce from 64 employees as of March 21, 2025, to an undisclosed number. This decision follows a previous round of layoffs in August 2024, which was prompted by slow enrollment in the BBI-355 trial.

These financial adjustments are expected to extend Boundless Bio's cash runway into the first half of 2028, providing sufficient resources to reach proof-of-concept clinical readouts for both the new combination therapy and BBI-940. This represents an extension from the previously reported runway that reached into 2027.

References

- Boundless Bio lays off 33% of staff as lead program stumbles

Boundless Bio is in a bind. A phase 1/2 trial has revealed the shortcomings of Boundless’ lead candidate, prompting the company to lay off one-third of its staff and pivot to a combination of two molecules that struggled as monotherapies.

Explore Further

How has Boundless Bio's financial performance fluctuated over recent years due to clinical trial outcomes?

What are the main factors that have driven the recent staffing reductions at Boundless Bio?

What are the backgrounds and previous roles of key executives who are leading Boundless Bio through its strategic pivot?

How do personnel changes at Boundless Bio compare with those of other biotech companies facing similar clinical trial challenges?

What potential impacts could these personnel and strategic changes have on Boundless Bio's long-term growth and research objectives?