Korro Bio Streamlines Operations to Advance RNA Editing Platform and Clinical Trials

Korro Bio, a biotech company specializing in RNA editing therapeutics, has announced a significant restructuring of its operations, including a 20% reduction in workforce, as it focuses resources on advancing its lead clinical candidate and expanding its innovative OPERA platform.

Strategic Layoffs and Resource Allocation

The Cambridge, Massachusetts-based company revealed in its first-quarter earnings report that it will lay off approximately one-fifth of its staff. This move is part of a broader strategy to streamline operations and prioritize the development of KRRO-110, Korro's clinical-stage candidate for Alpha-1 antitrypsin deficiency (AATD).

Todd Chappell, Chief Operating Officer of Korro Bio, stated, "Streamlining the organization is essential to enable Korro's long-term success. We will continue to prioritize the development of KRRO-110 while making focused investments in our OPERA platform to efficiently advance innovation."

The layoffs are expected to affect around 20 employees, based on the company's reported 104 full-time staff at the beginning of 2025. Korro anticipates incurring approximately $1.2 million in severance and related costs due to this restructuring.

Advancing KRRO-110 and the OPERA Platform

KRRO-110, Korro's lead asset, is currently undergoing a phase 1/2a trial in Australia and New Zealand for AATD. The company plans to expand this study into the United States and expects an interim readout in the second half of this year.

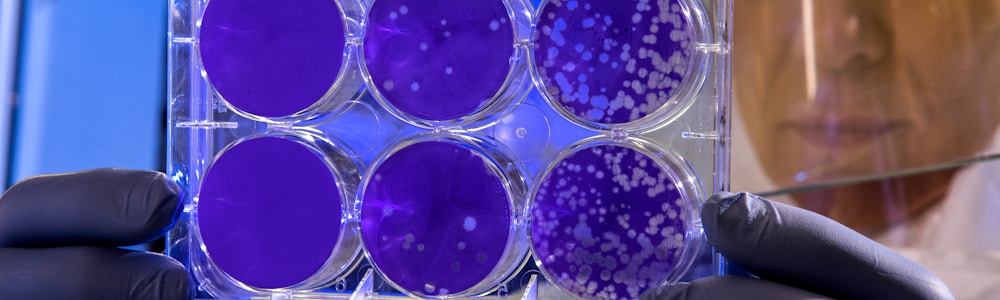

The drug candidate is an RNA editing oligonucleotide encapsulated in a lipid nanoparticle, designed to correct the AAT protein in liver cells. This approach leverages Korro's proprietary Oligonucleotide Promoted Editing of RNA (OPERA) platform, which aims to provide a transient and dose-titratable option in genetic medicine without the potential risks associated with permanent DNA editing.

Korro's ambitious "3-2-1" strategy aims to have three candidates in clinical trials by the end of 2027, all developed using the OPERA platform. This includes KRRO-110 and two preclinical programs in collaboration with Novo Nordisk, focusing on cardiometabolic-related targets.

Financial Outlook and Industry Positioning

Despite the restructuring, Korro Bio maintains a strong financial position, reporting $139 million in cash reserves as of March 2025. The company projects that this funding will sustain operations until 2027, allowing for continued advancement of its clinical programs and platform technology.

Industry analysts from William Blair have noted that upcoming readouts from competitors in the RNA editing space, such as Wave Life Sciences' WVE-006 for AATD, could have implications for Korro and its peers. The analysts believe that Korro's preclinical data for boosting corrected AAT levels in AATD may represent a potential best-in-class approach in the ADAR-mediated RNA-editing field.

As Korro Bio navigates this period of strategic realignment, the pharmaceutical industry will be watching closely to see how the company's focused approach to RNA editing therapeutics unfolds in the competitive landscape of genetic medicine.

References

- Korro lays off 20% of staff to fund genetic med trials, Novo Nordisk partnership

Korro Bio is laying off a fifth of its workforce as the Novo Nordisk-partnered biotech funnels resources to its clinical-stage candidate for a genetic lung and liver disease.

Explore Further

What factors led Korro Bio to decide on a 20% workforce reduction?

How does Korro Bio plan to address the resource allocation issue following the layoffs?

What potential impacts might the upcoming interim readout of KRRO-110 have on Korro Bio's strategic direction?

How do Korro Bio's financial reserves position it against competitors in the RNA editing field?

What are the implications of personnel changes in other biotech companies focusing on RNA therapeutics?