Ardent Health Services Eyes Expansion and Growth Opportunities Amid Changing Healthcare Landscape

Ardent Health Services, a for-profit health system that recently went public, is positioning itself for significant growth through a combination of strategic acquisitions, ambulatory care expansion, and potential joint venture opportunities. The company's executives outlined their plans during a KeyBanc Capital Markets Healthcare Forum, highlighting early successes and future strategies in a rapidly evolving healthcare market.

Outpatient Expansion and Urgent Care Acquisitions

Ardent Health has made substantial moves in the outpatient care sector, acquiring 27 urgent care clinics across multiple states since 2024. CEO Marty Bonick reported encouraging results from these acquisitions, noting that the first six centers purchased in Texas last year have generated about 45% new patients for the health system.

"We're seeing the pull-through of those patients," Bonick explained. "About 15% of them, within 30 days, are needing follow-up services, they need a specialist appointment, they need a scan, they need a procedure done. So we're seeing that pull-through come."

The company is now setting its sights on ambulatory surgery centers (ASCs) as the next focus area for expansion. Bonick indicated that this growth would likely be "more heavily tilted towards de novo" openings rather than acquisitions, citing the potential for more efficient builds and physician partnerships.

Financial Performance and Growth Targets

Ardent Health reported strong financial results in its most recent quarter, with $1.61 billion in total revenue, $183 million in adjusted EBITDA, and $114 million in net income attributable to the company. For 2025, the health system is targeting total revenue between $6.2 billion and $6.45 billion, with adjusted EBITDA ranging from $575 million to $615 million.

The company's balance sheet remains robust, with over $550 million in cash and a lease-adjusted net leverage ratio of 2.9 times as of December 31. CFO Alfred Lumsdaine emphasized the company's commitment to maintaining financial discipline, stating, "I would view four times as sort of a ceiling for us, and we would need to see a path towards delivering on any transaction we do within the first 18 to 24 months."

Joint Venture Opportunities and Nonprofit Partnerships

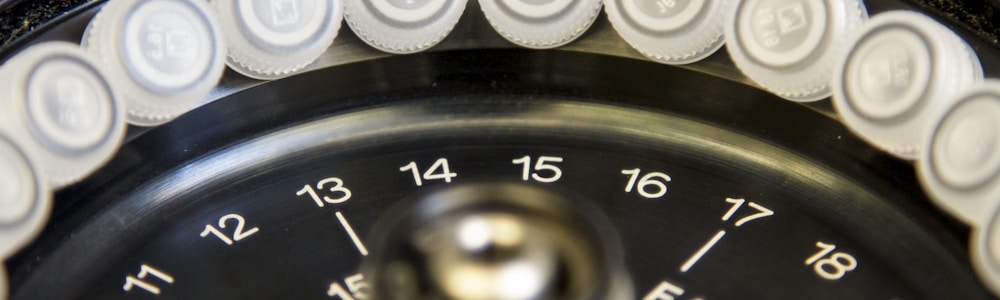

Ardent Health's unique joint venture model, which currently includes partnerships with 18 hospitals operated alongside major nonprofit systems or academic medical centers, is seen as a key differentiator and growth driver. The company's executives expressed optimism about expanding existing partnerships and potentially forming new ones, particularly in light of financial challenges facing many nonprofit health systems.

"About 40% of hospitals are losing money, and with some of the impending potential changes in regulatory policy, that could exacerbate that situation for a lot of nonprofit hospitals," Lumsdaine noted. "We think we have a proven track record working with academics and the needs that they may have."

Bonick added that Ardent is engaged in "a number of conversations with academics whether it's about a proposed transaction or just exploratory looking for opportunities as they arise." The company is particularly interested in multihospital systems with room for outpatient expansion, although outright acquisitions are not ruled out if the opportunity aligns with Ardent's strategic goals.

As Ardent Health Services continues to evolve from a "hospital-centric company" to a "comprehensive healthcare system," its focus on strategic growth, financial discipline, and adaptability to market trends positions it as a notable player in the changing landscape of U.S. healthcare delivery.

References

- Ardent Health execs eye outpatient expansion, see nonprofits' headwinds as growth opportunity

Executives of the public for-profit outlined early success from deals to flesh out their networks and said they are an appealing dealmaking partner to nonprofit and academic health systems fretting changes in Washington.

Explore Further

What is Ardent Health Services' strategy for identifying and evaluating potential acquisition targets in the urgent care and ambulatory care sectors?

How does Ardent Health Services plan to manage the financial risks associated with its ambitious growth targets and expansion plans?

What impact do regulatory changes and policy shifts in healthcare have on Ardent Health Services' joint venture opportunities?

How does Ardent Health plan to leverage its partnerships with nonprofit systems and academic medical centers to enhance its market position?

In what ways does Ardent Health's financial performance and growth targets compare to its main competitors in the healthcare market?