GSK Abandons CD226 Cancer Therapies, Shifts Focus in Pharmaceutical Pipeline

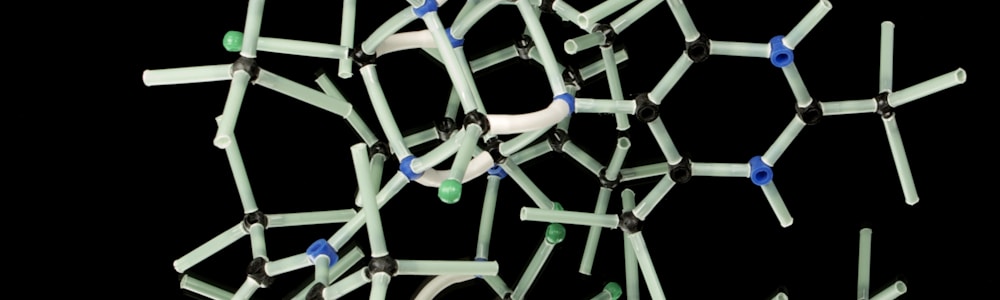

GSK, a leading pharmaceutical company, has announced significant changes to its drug development pipeline, marking a strategic shift in its oncology and infectious disease programs. The company's third-quarter earnings report revealed the discontinuation of several key projects, most notably its ambitious CD226 axis cancer therapies.

CD226 Cancer Program Closure

GSK has officially terminated its remaining phase 2 assets targeting the CD226 axis, effectively ending its pursuit of what was once considered a promising new area for next-generation immuno-oncology therapies. This decision follows the earlier discontinuation of the anti-TIGIT antibody belrestotug, developed in partnership with iTeos Therapeutics, which resulted in a substantial impairment charge of 471 million pounds sterling ($629 million).

The latest casualties in GSK's oncology pipeline include:

-

Nelistotug (GSK6097608): An anti-CD96 antibody developed in collaboration with iTeos and 23andMe. The phase 2 study, which began in 2023, was evaluating nelistotug in combination with GSK's immunotherapy Jemperli and the discontinued anti-TIGIT drug belrestotug for recurrent/metastatic PD-L1 positive squamous cell carcinoma of the head and neck.

-

GSK4381562: An anti-PVRIG antibody licensed from Surface Oncology, previously in phase 2 development for advanced solid tumors.

Emma Walmsley, GSK's outgoing CEO, commented on the decision, stating, "It's perfectly normal that we switch off some things. The really important thing is we do it before it becomes expensive, and then we refocus all of our energy on the things that have high potential and that can be really big."

Pipeline Restructuring Beyond Oncology

The company's pipeline adjustments extend beyond oncology, affecting several infectious disease programs:

-

GSK4023393: A second-generation meningitis vaccine for serogroups A, B, C, W, and Y, which was in phase 2 trials for infants. This decision comes in the wake of FDA approval for Penmenvy, GSK's MenABCWY vaccine for 10- to 25-year-olds.

-

Cytomegalovirus vaccine: A phase 2-stage recombinant subunit vaccine has been discontinued.

-

GSK3915393: Development of this TG2 inhibitor for pulmonary fibrosis has been halted, following its previous termination in celiac disease.

-

GSK4172239: A DNMT1 inhibitor for sickle cell disease has been removed from the phase 1 pipeline.

Strategic Realignment and Future Focus

While GSK is closing several programs, the company is signaling a shift towards other promising areas, particularly antibody-drug conjugates (ADCs). Walmsley emphasized that the ADC portfolio is "one of the key things that you'll hear a lot more about over the next couple of years."

This strategic realignment underscores the dynamic nature of pharmaceutical R&D, where risk appetite and capital deployment decisions are crucial. As Walmsley noted, "The pharma industry requires risk appetite in terms of the deployment of R&D capital, and most things don't actually work."

As GSK navigates these changes, the industry will be watching closely to see how the company's renewed focus on areas like ADCs will shape its future in the competitive landscape of drug development.

References

- GSK abandons hopes for CD226 cancer therapies, dropping remaining phase 2 assets

GSK once dreamed of harnessing the CD226 axis to create a new generation of blockbuster cancer drugs. But that dream appeared to die this morning as the pharma closed the last programs related to this modality.

Explore Further

What are the key factors that influenced GSK's decision to terminate the CD226 axis cancer therapies despite their initial promise?

What are the future prospects and competitive advantages of GSK's focus on antibody-drug conjugates (ADCs) in its pharmaceutical pipeline?

How do GSK's discontinued oncology and infectious disease programs compare to similar initiatives undertaken by its competitors in the drug development field?

What is the potential market size and clinical impact of GSK's remaining oncology assets, including Jemperli?

What implications will GSK's strategic realignment have for its financial performance and R&D priorities in the coming years?